In Nigeria, the solid mineral sector is experiencing a revisit and therefore, increasing government and private sector attention following the herald of economic diversification and industry reforms since 2016. The 2018 State Disaggregated Mining and Quarrying report published by the Nigeria Bureau of Statistics counted 43 different solid minerals across the states of the federation. Despite stagnating nominal growth rate in the mining sector, the mining sector real contribution to GDP has been improving.

Recent data from the Nigerian Bureau of Statistics (NBS) Nigeria’s Gross Domestic Product (GDP) grew by 1.94% in Q2 2019. The Mining and quarrying sector contribution to GDP was 8.84 percent, a decline of 11.47 percent from Q1 2019 and 28.3 percent in corresponding year-ago quarter.

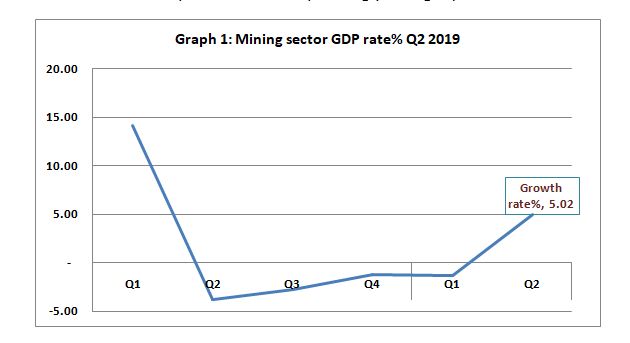

The real sector grew by 5.02% (year-on-year) during the second quarter of 2019. This was 8.85% points higher compared to the same quarter of 2018 and 6.38% points higher than the first quarter of 2019. On a quarter on quarter basis, the growth rate recorded was –0.72%. The contribution of Mining and Quarrying to Real GDP stood at 8.97%, slightly higher than 8.71% recorded in the corresponding quarter of 2018 but lower than 9.29% recorded in the first quarter of 2019.

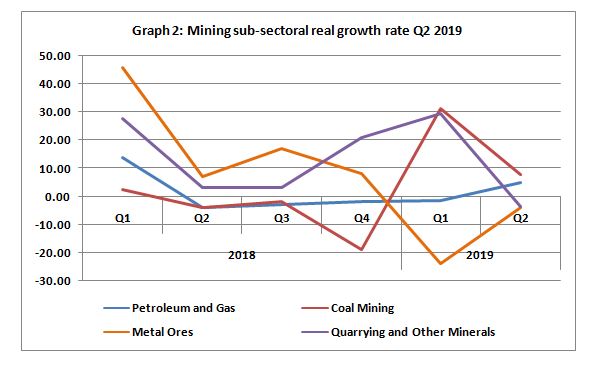

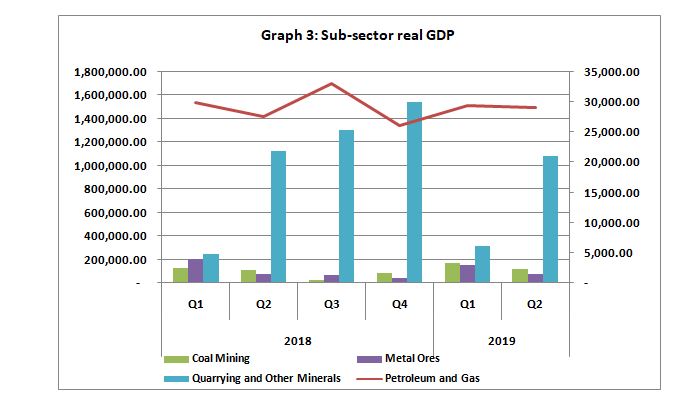

The chats in graph 3 show that crude petroleum and natural gas accounts for the most fractions in the Mining sector GDP, followed by quarrying. The representation in graph 3 shows the trend in the subsectors: the production of crude petroleum and natural rises and falls in the same pattern as quarrying, even though latter rises and falls faster. The trend also reveals some seasonality in quarrying as it falls sharply in Q1 and picks up in Q2. More so, there has been a significant uptick in the activities around metal ores and coal mining since the solid mineral roadmap in 2012 and 2016 – notwithstanding the seasonal deep in coal mining every Q3 and Q4 for metal ores activities since 2015.

Snapshot of solid minerals output by regions

The total output of solid minerals in Nigeria across states and regions in 2018 stood at 55.8 million tons compared to 45.8 million tons in 2017 and 43.44 million tons in 2016. South-west followed by North-central tops the list with a total output of 20 million ton 18.21 million respectively – accounting for 35.82 percent and 32.62 percent respectively.

The data from NBS show that Limestone alone accounted for 48.7 percent of the total production of solid minerals in 2018. Granite (17.24 percent), Laterite (9.08 percent) and Clay (7.21 percent) are among the largest solid mineral production. The laggards include Topaz, Ruby and Garnez.

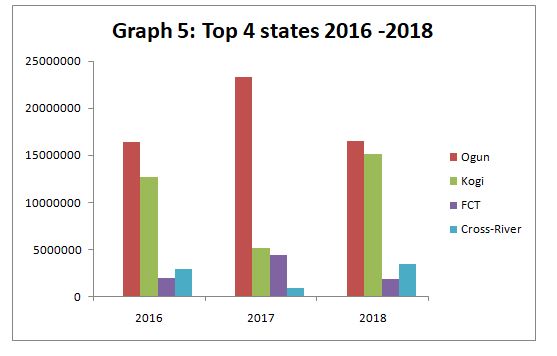

Ogun state, South-west Nigeria retains the largest solid mineral output across the country. It is the major bolster in the region in terms of solid mineral production. Ogun state accounts for 29.53 percent of the total output in 2018—a 41.95 percent decrease from 2017. In 2017, the state claimed 50.89 percent of total national output. The graphics below shows a declining output since 2017.

Kogi state is another top performer in terms of solid mineral production. Like Ogun in the South-west, it is the major anchor in the North-central. It recorded significant output growth between 2017 and 2018. It recorded an output growth of 189.45 percent between 2017 and 2018 contributing 27.1 percent of total national output in 2018. Other top performers include Cross-River and FCT with 6.25 percent and 3.4 percent respectively.

Plateau state – North-central – has the most varieties of mineral deposit with a count of 19 different solid mineral endowments. It, however, accounts for only 0.16 percent of national output. Nasarawa, another state in the North-central takes the second position in the count of mineral deposits with a total count of 13 different solid minerals. It suggests that the vast land in the region is richly endowed with a variety of mineral resources.

The South-east is the least in terms of output with a total production of 2 million tons representing 3.69 percent of the total national production. Whereas Ebonyi state is the lead performer in the region with significant production in granite and lead, Imo is the least performer with recorded production in Sand dredging alone.

The least performers across region include Borno (8403.30 tons), Rivers (19548.68 tons) and Yobe (41,591.49 tons). It is not clear whether the limitation in production in Borno and Yobe is due to insurgency in the region or the quantum of minerals available, but the overdependence in crude-oil exploration crowd-out interest in other sectors.

Remarks

In conclusion, there is room for progressive investments across regions dwelling on the mineral demographics. The positive trend in real GDP connotes positive efforts and feedback in the sector.However, the production output in Limestone, Granite and Clay suggests that explorations are lopsided towards cement and construction materials. It may be necessary to look into other diverse mineral endowments of economic importance; rely on the private sector participation and other stakeholders to expand the base of production.