The stock market is a mechanism that enables risk sharing and wealth accumulation. No wonder it continues to surprise and interest financial experts that most individuals do not invest part of their wealth in the stock market – a phenomenon dubbed non-participation puzzle. While financial illiteracy may explain some non-participation, it is common to find financially literate people that do not participate in the stock market.

Background risks, which are undiversifiable risks such as human capital risk, labor-income risk, and health risk, generally explain why many individuals do not invest in risky financial assets. The idea is that when individuals face such independent risks, they are less willing to expose themselves to risky assets. Indeed, background risks are notoriously high in the Nigerian socio-economic environment, due to high economic uncertainty and zero social safety net. However, that individuals in Nigeria still take other avoidable risks, e.g., willingness to build start-ups and migrate to new environments to start life afresh, suggests that background risks are not the whole story.

Other common reasons why literate individuals shun the stock market are “it’s too risky”, “it’s simply gambling”, and “I don’t have time for it”. For most people, particularly the young, these reasons are simply nonsensical; they stem from misunderstanding. Let’s begin with “it’s too risky”. Financial research tells us that no amount of risk aversion can justify non-participation in the stock market. If you are more risk-averse, it would only necessitate reducing the share of risky assets in your portfolio, not non-participation. Moreover, higher risk generally means higher reward, and there are simple ways to reduce the risk of financial investments such as diversification.

The gambling claim depends on one’s investment horizon. A short-term investor looking for quick gain may be justified to see the stock market as a casino. This article is not for such individuals. For the long horizon investor, the stock market is not a gambling scheme. The expected return, i.e., the anticipated gain on investment, from the stock market is generally positive. This is not the same for casino gambles or “Betnaija”, which have high probability of losses and small probability of big wins that often generate negative expected value.

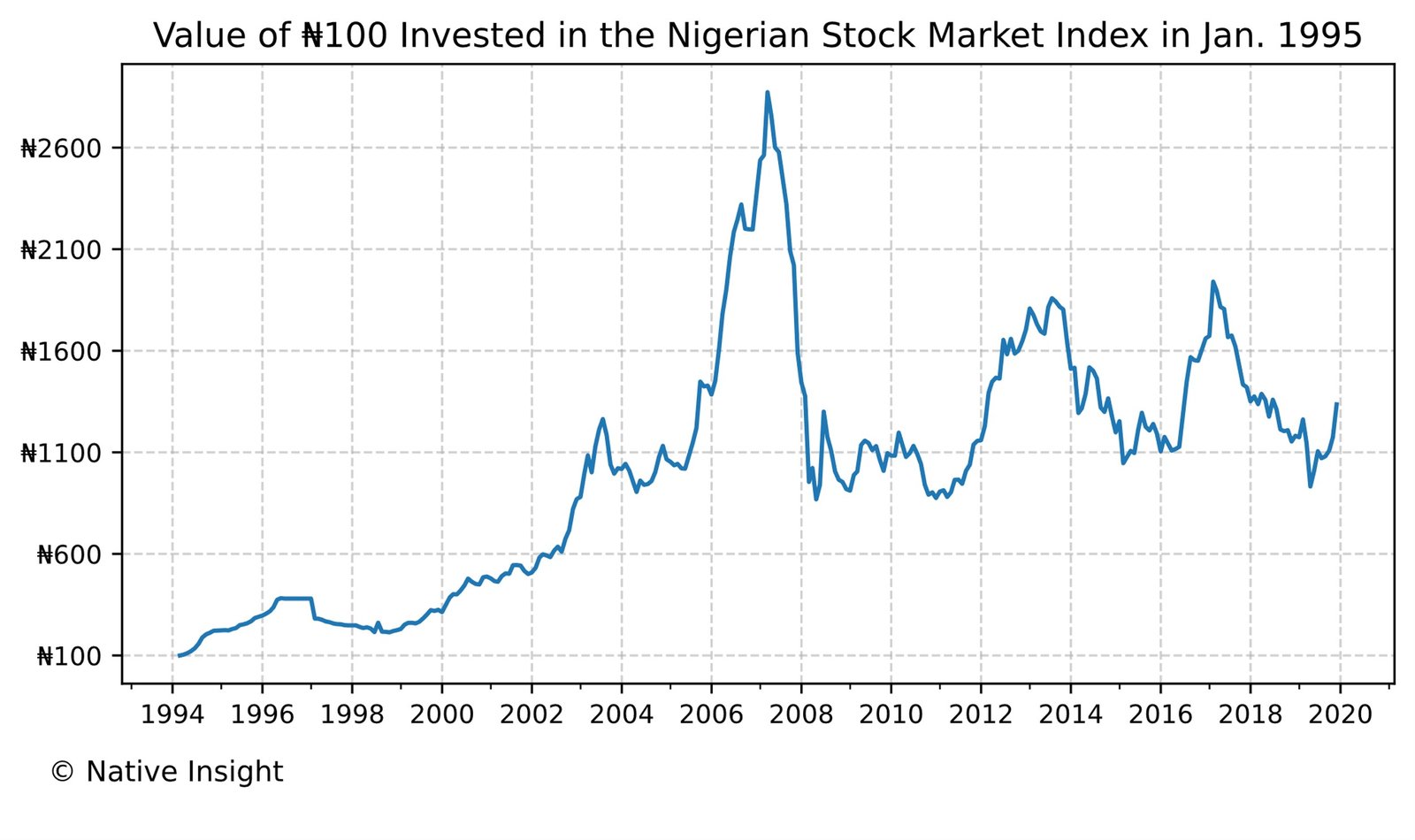

To drive home the point, Figure 1 shows the value, over time, of ₦100 invested in January 1995 in a portfolio that tracks the Nigerian All-Share Index. Despite the huge volatility in the value over time, by October 2020 the ₦100 would have risen by more than ten times to ₦1,400. Compare this to depositing the ₦100 in a savings account, which is what most people mindlessly do, at a “generous” yearly interest rate of 3% p.a. By October 2020 the money would be worth only roughly ₦210, and the investor would have lost the opportunity to make an additional “risky” ₦1,190 through the stock market. No wonder Robert G. Allen aptly asked, “How many millionaires do you know who have become wealthy by investing in savings accounts?”

Therefore, that the stock market is risky does not make it a gambling scheme, since over the long run you are sure of reaping positive returns from your investment. The stock market does not reward investors for nothing. The returns are compensation for sharing in the risk of businesses, as well as for transferring liquidity to yesterday’s investors that need to cash-out and consume today. This crucial activity enhances the economic growth and collective welfare of societies.

Figure 1: The value of N100 investment from 1995 through 2020

The claim of some individuals that they lack the time to follow individual stocks and make an informed investment is indefensible because financial practitioners have designed products, such as passive mutual funds, active mutual funds, and exchange traded products, that solve precisely this problem. Furthermore, basic investment wisdom advises that if you do not have superior information to guide selective investment in specific stocks, then it is optimal to invest in a well-diversified portfolio that represents the market. Such passive portfolios, packaged as “passive mutual funds” or “Index-based exchange traded funds”, have long existed in the Nigerian stock market. You need not do more than open a brokerage account to buy such funds and easily replicate the performance in Figure 1. For individuals that believe in doing better than the market with selective-investing, “active mutual funds” aim to achieve that. However, active funds cost more and fail to consistently beat the market after fees and expenses.

Common Pitfalls in Stock Investing

With the assumption that false doubts have been cleared and Figure 1 is encouraging enough, let’s turn to common mistakes individuals should avoid when investing in the stock market. The first is under-diversification due to familiarity bias. Examples include buying mostly the shares of the company you work for or the shares of companies in the same industry as yours. This common practice is wrong because your investments would end up losing value when you are least equipped to cope with the loss. Examples are when your industry and employer are facing severe financial turmoil and you face a high risk of losing your job. A better strategy is to invest in a broad portfolio that includes several industries, companies, and, as is now possible in Nigeria, international stocks. That way, one stock’s loss can be offset by another’s gain, hence reducing risk and in some cases not hampering return. As the Nobel Prize-winning economist, Harry Markowitz, famously stated, “diversification is the only free lunch in finance” – don’t miss it.

Next, avoid too much trading. Trading involves transaction costs, which add up to sizeable sums. Research shows that individuals that trade a lot underperform the market after accounting for transaction costs. Moreover, given that you are encouraged to invest in diversified portfolios for the long term, there is scarcely any justification for frequent trading. The final mistake to avoid is disposition-effect – the tendency to sell stocks that have gained in value while holding unto losing stocks. This is wrong for several reasons. For instance, it increases the present value of capital-gains tax obligations and defers the realization of offsetting tax benefits from capital losses. Moreover, since momentum – the tendency of stocks that have gained in value to keep gaining and vice versa – is commonplace in the stock market, disposition effect likely sacrifices further gains and accommodates further losses.

Recent research evidence shows that the rich keep getting rich due to high returns on their capital through investment in risky assets like stocks. Returns on capital far exceed returns on labor, which is a strong reason why one should put her money to work by investing in the financial market. When only the rich invest in stocks, inequality spreads and the poor miss out on opportunities to climb up the social ladder. Investing has become very cheap and easy. You can do it all with your mobile phone at little or no cost. Why not start building your financial fortune today!